There is a school of software engineering broadly referred to as “agile programming.” The basic distinguishing features of agile programming is that it is responsive to changing needs and gets as much done with as little extra overhead as possible. Advocates of this style are fond of saying “do the simplest thing that could possibly work” — a philosophy that I have found valuable far beyond the bounds of programming work. Applying this sort of thinking to my personal financial management has streamlined the process I use for managing money dramatically, and has resulted in some principles I thought worth writing up.

Note: this isn’t a comprehensive financial management plan. It’s just a high-level summary of some of the things I’ve found helpful and which deviate a bit from the common wisdom. You should take the time to understand the common wisdom before fooling with any of this stuff.

Requirements

The first stage in any software development project is to get some idea of what goal you’re trying to reach. In my case, my financial goals are pretty straightforward:

- Guard Against Identity Theft

- People swipe credit card numbers. The faster we can catch that sort of thing, the less trouble it is to sort out.

- Pay Bills on Time

- Obviously, it’s important to pay bills on time, as companies tend to charge usurious fees or disconnect your iron lung if you’re late.

- Be able to itemize deductions at the end of the year

- I have a lot of deductible expenses throughout the year, and end up paying a good deal less in taxes if I itemize.

- Save for retirement (and other stuff)

- I don’t want to have to work forever. This is my get-rich-slowly scheme.

- Know how much I can spend

- If I spend more than I have, I go into debt. Debt is expensive and demoralizing, and best avoided whenever possible.

- Spend as little time as possible messing about with money

- While I think it’s terrifically important to handle money well, it’s also terrifically uninteresting, and I would rather spend my time doing any number of other things.

In the spirit of “the simplest thing that could possibly work”, I try to throw out anything from my financial management practices that doesn’t directly serve one of these goals.

Design & Implementation

With a clear idea of what we’re trying to accomplish, it’s time to figure out how to reach those goals:

Goal: Guard Against Identity Theft

There are two aspects to this: preventing it to begin with (which I’ll call “prophylactic”, because it sounds racy) and detecting it quickly if it occurs to help minimize the damage done.

The prophylactic side of it is the stuff you’ve probably heard before. Use good passwords. Cover the keypad on the ATM when you get money. Don’t give any personal information to anyone who calls you on the phone, even if they claim to be from a legitimate organization. Don’t sign up for strange contests on the Internet.

But in addition to the precautions, you need to know quickly if someone’s using your credit card or sucking money out of your bank account. You can review your statements each month, but that means that someone could be bilking you for a long time before you notice. Plus it’s a hassle to go through a whole month of transactions which are no longer fresh in your memory.

I use Yodlee, a free, online financial management service that aggregates information from all the banks, credit cards, and brokers I use. (There are several other good services as well: Wesabe and Mint are two of my other favorites.) By simply clicking the “Transactions” button each Saturday morning, I can review all the transactions in all of my accounts over the past week at a glance. Even better, I can configure Yodlee to text me if it sees any transactions above $500 or that look suspicious according to other guidelines I set up. It’s easy to check for odd activity, because the transactions are fresh in my memory, and there’s only a week of them to look at.

The best aspect of this approach? It only takes about 5 minutes per week — often less.

Goal: Pay Bills on Time

Paying bills is one of my least favorite things to do. Fortunately, there are a few things that make it a lot easier than it used to be.

Lots of vendors, like cable companies, phone companies, and city utilities provide an electronic bill pay service. The advantage to these is that they’re convenient, you know that your bills will be paid on time, and they’re free. The disadvantage is that they require you to essentially give those vendors the keys to your bank account, you don’t have direct control over when those bills will be paid, and if your balance runs low or you decide to switch banks, things can get very messy.

Another alternative that I particularly like is my bank’s online bill pay service. Most banks offer this now for free, since it’s much less costly for them to process electronic funds transfers than it is to process little pieces of paper. (They’ll fall back to generating actual checks when necessary.) With this option, paying bills is as quick as filling in a small form on their website. (If it’s someone you’ve paid before, you need only enter the amount in the appropriate field.) You retain control of when your bills are paid, and if you change banks or have difficulty with the vendor, there are fewer pitfalls. The downside is that most of these services need 3-7 days lead time to pay a bill, which can make timing a bit tight at times.

Whichever of these you use, take advantage of the automation options they offer! For bills that are the same amount each month, you shouldn’t even have to think about them — just set it up once, and let the recurring payment option take care of it for you in the future. Since I’ve switched to using electronic bill pay services and automated the predictable charges, paying bills only take a few minutes a week and I no longer have to buy stamps.

Goal: Be Able to Itemize Deductions

In order to be able to itemize your deductions, you need to be able to find all your business expenses, educational expenses, healthcare expenses, charitable gifts, etc. If your records are on paper, this is an enormous pain. However, if all your transactions are already going through Yodlee or a similar service, it becomes an easy matter, when you do your weekly check for unauthorized transactions, to categorize these transactions appropriately. Some services will recognize transactions of a particular type and tag them automatically for you, saving you even more time. Having correctly categorized data makes it fast and easy to generate reports at year’s end with all your deductions listed.

Another handy trick is to establish multiple accounts and to use an appropriate one when you spend money. We have an account dedicated to charity; whenever we give money away, we draw it from that account, making it even easier to recognize those expenditures when the Tax Man comes knocking.

Time cost: another 5 minutes or so a week to tag transactions, but with hours, frustration, and dollars saved at the end of the year when filing taxes.

Goal: Save for Retirement (and Other Stuff)

The easiest way to save for retirement is to have the money scraped off your paycheck before you ever see it. If your employer offers a 401K, automatic deductions should be easy to set up. (Also, if your employer offers matching funds for your 401K contributions, do whatever you need to do to max that out. It’s free money, folks!)

If you don’t have a 401K through your employer, it’s easy enough to set up an automatic draft to suck the money out of your checking account and into an IRA automatically. Again here, automation is your friend — the less you have to think about doing the right thing, the more likely you are to actually do it. And remember to set aside a minimum of 10%, more if you’re starting late. It’s tough to do, but is much easier than eating cat food when you’re 70.

Where to invest that money? As a lazy investor who still wants good returns, I’m a big fan of index funds. These are designed to match the performance of the Dow Industrials, the S&P 500, or another stock market index. Because there are few decisions to be made in managing those funds, their management fees tend to be very low, and they outperform about 90% of the mutual funds out there. If you lack time or inclination to research funds (or even if you don’t), these are a great way to go.

Groovy sidenote: by investing regularly, you take advantage of something called “dollar cost averaging”. Here’s how it works: Let’s say that AAPL shares cost $4 in March and $6 in April, so the average price for them is $5 over that two month span. Now, if you bought $120 worth of Apple stock each month, you would have bought 30 shares in march and 20 shares in April. Your total cost for the 50 shares you now own is $240, or $4.80 per share — $0.20 less than the average price over that time period. By buying regularly, you automatically get a bargain. Cool, eh?

Automatic withdrawls are also a good way to save for expensive purchases, like vacations or cars — just have your bank automatically put that money aside into another account automatically whenever your paycheck comes in. You don’t have to think about it, and it earns interest while you ignore it.

Weekly effort to save for retirement: none whatsoever.

Know How Much I Can Spend

This is where I part company with a lot of financial management folks.

The common wisdom is to figure out how much you spend on various things through your week — coffee, eating out, groceries, entertainment — and to track those individually. If you’re out of grocery money, then you either wait on groceries, or pull money out of another area.

This is both inflexible and an economy-sized pain in the butt.

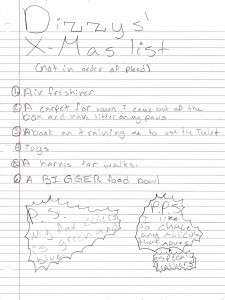

My approach? Figure out how much money you have left for the month after putting aside savings, paying bills, paying down debt, insurance, etc. We have a tiny little one-page spreadsheet we use for this. (If you don’t know how much a given bill will be from month to month, be pessimistic. It’s much better to find you have more money than you need than not enough.) Take that monthly number and divide it by 4. (Or 4 1/3, if you’re precise: 52 weeks ÷ 12 months.) Then get that much money out of the bank in cash at the beginning of the week. When you run out of money, stop buying stuff until the next week.

The beauty of this approach is that it’s drop-dead easy to see how you’re doing on your spending. You’re never surprised to find when your debit card statement comes that you spent twice as much as you thought. If you run out of money during the week, it’s never that long to wait until your next “payday”. (Also, if you’re a privacy nut, the government can’t tell where you’re buying the tinfoil for your beanies if you pay cash.) You can spend more on groceries this week, and then go nuts on buying action figures next week, without it adding to your money management workload.

(An important side note: it’s vital to have an emergency fund of two-three months of your salary. This allows you the flexibility to pay to have your car repaired when it explodes without hurling you into debt. Establishing this is a good first priority if you’re just getting your financial house in order.)

Spend as Little Time as Possible Messing with Money

The most interesting thing about this approach is what I don’t do any longer. Among these:

- I don’t reconcile statements when they come in. Because I’m already checking that the bank records look OK when I do my weekly check for suspicious transactions, there’s no longer a need to pore over every bank statement. This theoretically opens the door for the bank to take a few dollars extra from my account without me noticing. But in the past, every time I spent hours figuring out why my balance sheets were off, it turned out to be my fault, so this is a risk I’ll happily take in exchange for getting all that time back.

- I don’t review many transactions. Because I buy most stuff during the week with cash, the number of transactions is far fewer than when I was using a debit card for everything.

- I don’t obsessively categorize my records. I love charts and graphs as much as (ok a lot more than) the next guy, but making them was the only benefit I got out of tagging and categorizing all my spending. Now I just tag the stuff I think I can claim a deduction for, and leave the rest pretty much alone. If I decide I need more exhaustive data, it’s not hard to go back and add the necessary categories, but it hasn’t seemed worth the effort yet.

- I don’t spend much time dealing with money. My weekly bill-paying sessions take about 25% of the time they used to, and I’m convinced that my money is being handled at least as wisely.

- I don’t stress about it when I buy something. I know how much money I’ve got, because I can see it in my wallet. If I stop spending when I’m out of money, I know that my finances are in order.

Conclusion

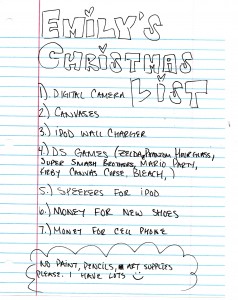

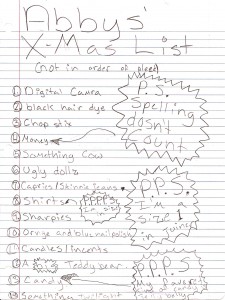

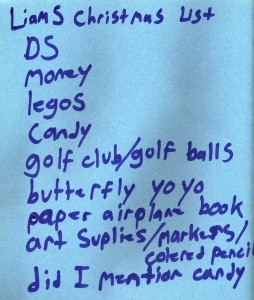

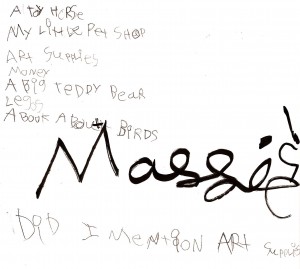

Though it’s taken a long time for me to get to this point, this approach has made dealing with finances for a family of six much less of a time-consuming hassle than it has ever been before. I’ve gotten back a chunk of my Saturdays, and my family is doing well with our financial goals. It doesn’t take much green-eyeshade work, and is easy to adjust as conditions change. I hope that some of the ideas here will benefit some of you, and help you save you both effort and worry.

Questions and comments are welcome!